If you want to know the real economics of the pizza business, you’ve clicked the right link. How much can a pizza shop, franchised or independent, make a year? How does pizza store revenue vary from country to country? What profit margin is attainable — and what impacts this number in the pizza business? We have the answers.

This research is based on our own data from pizza stores in 14 countries, plus an analysis of the publicly available figures, and even some gossip we’ve heard from our peers.

Public pizza company reports as a source of sales data

There are a bunch of public pizza companies that are obliged to disclose their financial statements, and they’re a great source of reliable pizza sales data. As a rule, you’ll find store count and system sales in their annual reports, at the least. Divide sales by store count, and you’ll get the average. Just keep in mind that in most cases, the final number will be a slight underestimate, depending on the number of new units that have opened during the year in question (as it takes time for a new location to reach its potential). To estimate the profit margin, we’ll have to rely on other sources (more about it later).

Domino’s: from $22K in the US to $4.9K in Turkey

Domino’s reported a total of 6,126 units (+250 new) in the US and $7,044m in annual US system sales in 2019. Which gives us a rough figure of $22,000 in weekly sales.

Domino’s Pizza Group is the brand’s master franchisee in the UK and a handful of countries in Europe. Its 2019 report directly discloses average sales per unit in Great Britain — £19,860 (no data on other countries, unfortunately).

Domino’s Pizza Enterprises holds the rights for Australia, Japan, and some markets in Europe. Oddly, its 2019 statements disclose relevant figures only for Japan: $591.4m in network sales and 600 units, which gives us a rough average of $18,960. Across all of its markets, the company averaged $22,100 in weekly sales per store.

DP Global is the master franchisee rolling out Domino’s in Turkey, Russia, Georgia, and Azerbaijan. The company’s regional sales, revealed in an update for 2019, are as follows (converted from lire to dollars at the December 2019 exchange rate): Turkey $4,980; Russia $8,018; Georgia and Azerbaijan $5,712.

Pizza Hut: $16.8K in the US and $13K globally

Pizza Hut is another pizza brand that might be interesting for our little sales study since it represents a different approach to the pizza business with an emphasis on dine-in instead of delivery.

This pizza concept belongs to Yum! Brands. According to the latest company report, the brand’s average per unit for 2019 was around $13,000 globally.

QSR magazine’s Top 50 fast-food chains ranking states that in 2018, Pizza Hut averaged $878,000 in annual sales in the US, which gives us around $16,800 in weekly sales.

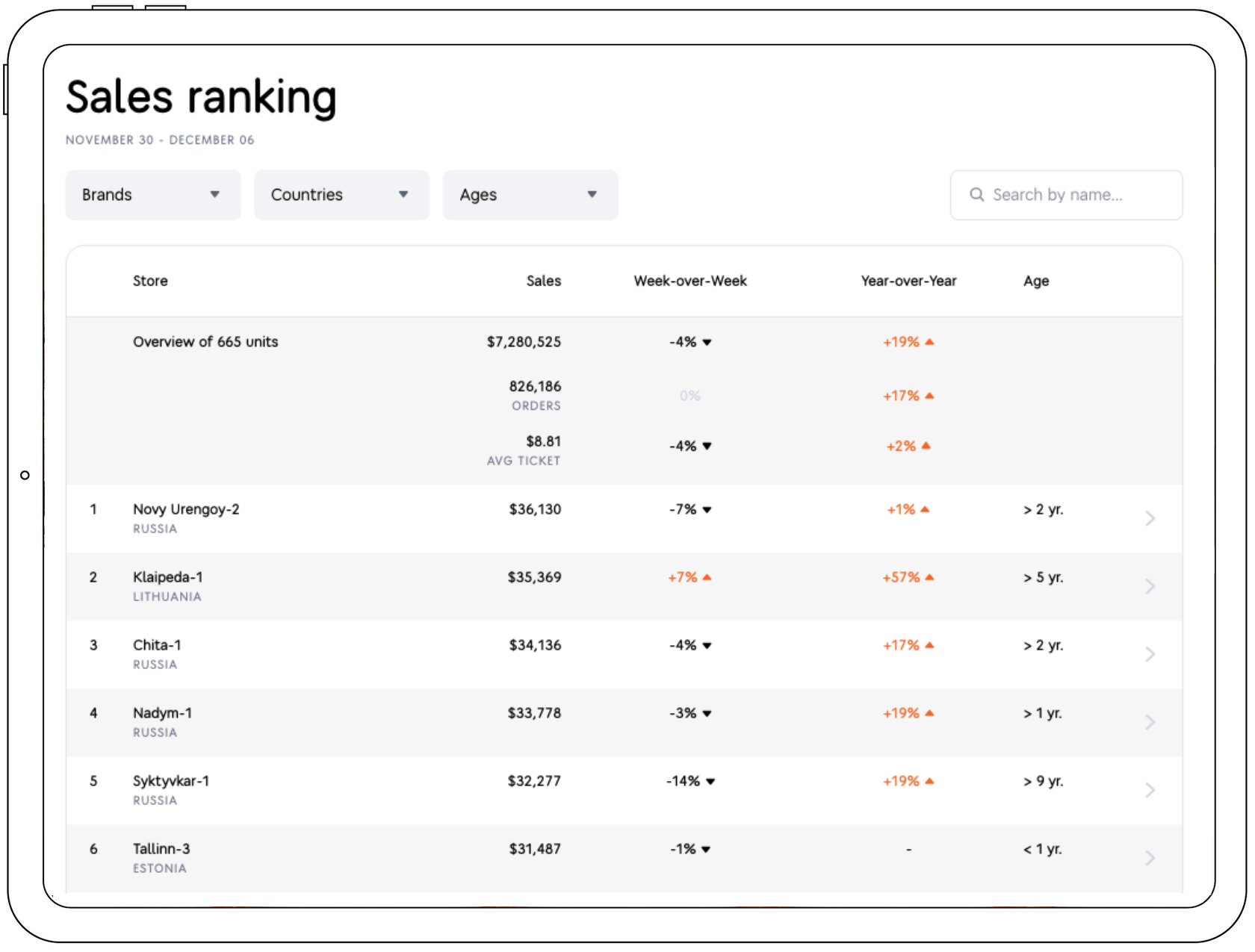

Dodo’s own Store Sales Ranking

Dodo Pizza isn’t a public company, as well as Dodo Brands, our parent company. But as a franchise born only in 2011, we are daring to build a new-generation global enterprise based on the principle of radical transparency. So our team makes most of our financial data freely available online.

At first, we employed a simple Google spreadsheet to share our monthly sales with our partners and the wider world. But, with units, it has bloated to an enormous file which is hard to navigate.

Luckily, right on this website, we now maintain a more convenient weekly Store Sales Ranking. Click on any unit in the ranking, and you’ll find a page with an even more detailed financial overview of the shop in question.

Dodo Pizza in 2019: from $27K in Estonia to $3.3K in China

For the sake of fair comparison, we crunched our own numbers for 2019 just the same way as we did with public companies — dividing sales by the number of units. Here is our country-by-country breakdown for average weekly sales (and store count in brackets):

- Estonia: $27,430 (2);

- Lithuania: $16,060 (4);

- Russia: $10,800 (496);

- Romania: $10,690 (6);

- Slovenia: $9,060 (1);

- Kyrgyzstan: $8,880 (3);

- Kazakhstan: $8,310 (37);

- Belarus: $7,150 (16);

- USA: $6,430 (2);

- UK: $4,150 (4);

- Uzbekistan: $3,930 (2);

- China: $3,340 (2).

When comparing countries, keep in mind that they differ in terms of cost of living — and one dollar earned in one country isn’t always equal to a dollar earned in another. Our average ticket in Russia is around $11 — and more than $16 in Lithuania.

Also, it’s worth mentioning that public companies report net sales (cleared of VAT or sales tax), while Dodo Pizza reports gross sales (but a majority of our units in Russia are exempted from paying VAT).

Our best-performing units: $1m+ in annual sales

Our Store Sales Ranking gives an even better insight into the pizza business presenting not only averages but also the extremes.

As I write this at the beginning of June 2020, our best-performing unit in Novy Urengoy, Russia tops the ranking with $39,479 in weekly revenue — and this is in the midst of the coronavirus pandemic, with zero dine-in sales (on-premise dining is still banned in Russia). The unit reports an impressive total of $1,955,304 in annual revenue (for the 12 months from June 2019 to May 2020).

Another example is our first unit in Vilnius, which grossed $24,939 in sales last week (only 54% of it coming from delivery). With its steady performance, this Dodo Pizza store saw $1,276,173 in annual sales — about as much as our second shop in Tallinn, Estonia ($1,212,463). Overall, we consider any unit a success if it brings in $1m+ in annual sales.

City legends: how big a business can a pizzeria be?

How high can sales soar? For us, it looks like $2m annually is the limit. But so far, we haven’t penetrated the most lucrative pizza markets such as the US and UK, where pizza sales trend higher than anywhere else in the world.

Dodo Pizza operates a few units in both regions but currently they serve more as our R&D labs where we test different ideas and search for the best product/market fit. How well are the brands that have already found their product/market fit in Great Britain or the USA performing?

Rumor has it that in the US, the most successful independent pizzerias focused on dine-in hit $2m, while franchised pizza deliveries in the US can reach as high as $3m in annual sales. This is the kind of achievement that will get you on stage during a big franchise gathering. You’ll receive a Rolex from the franchise CEO and envious glances from your peers.

Pizza business profit margin: 15%

By now, you should get the general picture and start wondering how much profit a pizza business can generate.

Obviously, the actual profit margin will depend on lots of factors (more about that below). But our financial model assumes that reaching a 15% store-level EBITDA is an attainable goal for a moderately successful pizza store. As far as we know, a profit margin of this size is considered the industry standard.

This means that with around 1m in annual sales, you can expect to make $150K in pre-tax profit. Also, the word “store-level” means that if you operate a few units, you’ll probably need at least a small office to manage them. Its costs will likely bite off some of the profits generated by your stores.

Pizza business profit margin extremes: from 25% to 0%

How far can the pizza business profit margin deviate from the usual 15%? Well, it can easily be as low as 0% or even less (meaning, you’re losing money when running your pizzeria). But in some cases, it might go up to 20% or even 25%. But this high level of profitability is really hard to achieve and reaching it entails true mastery of the foodservice business.

Your profit margin is defined by food and labor costs

In order to understand what makes some people lose money in the pizza business and some generate a steady income, let’s take a look at the key areas of expenditure:

- Rent and utilities — what you pay the landlord. 5–10%.

- Food (Unit) Cost — what you pay your suppliers for ingredients and packaging. 20–30%.

- Labor Cost — what you pay your team (including all the related taxes and social benefits). 20–40%.

- Marketing — what you invest in promoting your business. 3–7%.

- Royalties — what you pay the franchisor (if it’s a franchised unit). 3–7%

There are other costs involved, but these are the main ones. And since rent is a constant that you can’t change, all the hustle and bustle usually revolves around the two largest — and most fickle and unsteady — areas: labor and food.

Labor and food costs combo: no more than 60%

These two work in tandem — ideally, together they shouldn’t go higher than 60%, and the whole “combo” of rent + LC + FC shouldn’t exceed 70%. (So if you lease a cheap space, you’ll have more room for LC and FC.)

In western countries food is cheap, labor is expensive, so you might be looking at a FC-LC ratio of 20–40%. In developing countries with less social protection and a lower cost of living, it might be balanced at 30–30% or even 35%-25%.

How your pizza business is positioned also has a great impact on your P&L. For example, if you aim for a better quality of ingredients, food cost will rise — and you’ll have to balance that either with higher prices or reduced labor cost.

How you manage your store is as important as a well thought-out business model. Labor cost can grow beyond reasonable levels if you don’t schedule your workforce properly or if you train and motivate your team poorly. Bad deals with suppliers, food waste, and improper stock management can easily increase food cost.

Sales first, profits second

It’s quite possible to see a million in sales annually but with zero profit — even with a solid business model. The opposite is also true — with proper management, you can increase your pizza business profit margin to 20% and even beyond.

Many amateurs in the foodservice business have a hard time accepting that the key to profitability is in sales.

When sales are high, you can optimize your labor cost and better utilize your fixed expenses such as rent, utilities, and the general manager salary. When sales are too low, reaching profitability will remain challenging — even if you pay attention to labor and food costs.

So first, you need to drive sales up — without thinking too much about profitability. Then, when you have the volume of sales, you can think about optimization and profit margins.

Study Dodo’s monthly report to see our profit margins

You can study how all this mind-bending theory plays out in real business by diving deeper into the numbers of Dodo Pizza’s company-owned stores. For our own (non-franchised) units in Russia we disclose not only the sales but also the profits.

Our Monthly Update shows store-level EBITDA for 25+ units we currently operate in three cities: Syktyvkar, Saint Petersburg, and Moscow.

As I write this, the latest numbers are available for March 2020. The best store-level profit margin we saw in that month was 25% in Khimki‑1, with Syktyvkar‑1, our very first pizza shop launched back in 2011, coming second with 23% EBITDA.

In our network, there are currently a number of new shops only building their customer base, so across the company-owned chain our store-level EBITDA averaged at 4.6%.